Dharavi Redevelopment: Dubai's STC Challenges Adani's Project Award in Supreme Court

In a high-stakes legal battle, a Dubai-based consortium has taken its fight for the massive Dharavi redevelopment project to India's Supreme Court. SecLink Technologies Corporation (STC) is challenging the cancellation of a 2018 tender, which it originally won, and the subsequent award of the project to the Adani Group in 2022. The case puts a spotlight on the transparency of mega-project tenders in India and has significant implications for foreign investor confidence.

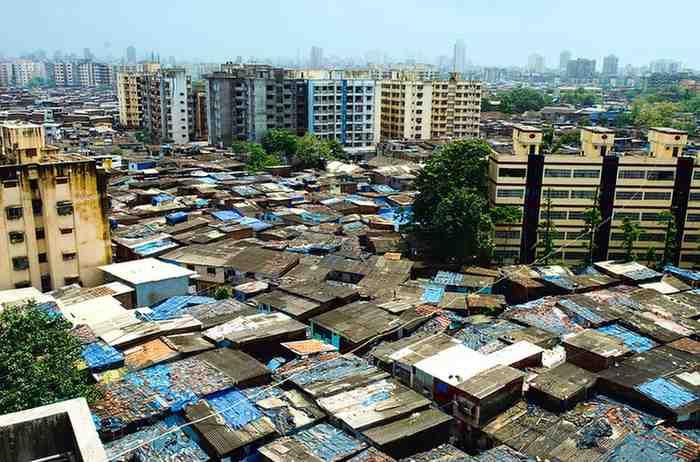

The Stakes: Asia's Ambitious Urban Transformation

At the heart of the dispute is Dharavi, one of the world's largest slums located in the heart of Mumbai. Spanning 2.4 square kilometers and housing over a million people, its redevelopment is one of Asia's most ambitious urban renewal initiatives. The long-term commercial value of transforming this prime real estate is estimated to be over Dh125 billion (approx. $34 billion USD), making it a highly coveted project.

Timeline of the Dharavi Redevelopment Dispute

The legal conflict stems from a series of tender cancellations and rule changes:

- 2018: The Government of Maharashtra launched an international tender for the project.

- 2019: STC emerged as the highest bidder in this initial process.

- 2020-2021: Before a formal contract could be signed, the state government cancelled the tender. Officials cited the need to include additional railway land and update the project's scope.

- 2022: A fresh tender was issued. Under these new criteria, Adani Properties was selected as the highest bidder with an offer of Rs 5,069 crore (about $600 million).

- 2024: STC's challenge against this award was dismissed by the Bombay High Court, which found no arbitrariness in the government's decision.

- 2025: STC appealed to the Supreme Court of India, escalating the legal battle.

STC's Core Argument: Unfair Exclusion and Financial Loss

The Dubai consortium contends that the cancellation of the 2018 tender and the introduction of new criteria were designed to unfairly exclude them. STC argues that the original tender had already accounted for the railway land, making the government's justification invalid.

The company has highlighted significant financial exposure, stating it had lined up $4 billion in bank guarantees and incurred substantial costs while awaiting the original award. STC's chairman has warned that the case sets a "worrying precedent for investor confidence" in India if a top bidder can be excluded after a tender process is complete.

Also Read: Dubai Ride 2025: Salik Announces Special Toll Rates & Peak Hour Charges for November 2

Government and Adani's Defense: Evolving Project Needs

The Maharashtra government and the Adani Group maintain that the tender cancellation and reissuance were justified. They argue that changes in the project's scope, including the formal inclusion of railway land, along with wider economic shifts and the impact of the COVID-19 pandemic, necessitated a fresh tender process. The Bombay High Court's dismissal of STC's plea initially upheld this position.

Supreme Court's Interim Orders and Next Steps

During hearings in March 2025, the Supreme Court took several critical steps:

- It noted that STC had submitted a revised bid of over Rs 8,640 crore, significantly higher than Adani's winning bid.

- It directed the state government to produce all tender-related files from 2018 for scrutiny.

- It ordered that all project payments be routed through a single, court-monitored bank account, effectively placing the project under judicial supervision.

- Crucially, the court refused to stay the project, allowing the Adani Group to continue redevelopment work for now.

The next hearing is scheduled for mid-November 2025, where the court will examine the complete tender record.

Implications for India's Infrastructure Future

The outcome of the Supreme Court case on Dharavi will have far-reaching consequences. It will not only determine the fate of one of Mumbai's most significant urban projects but also set a legal precedent for how large-scale public tenders are conducted in India. The decision will be closely watched by domestic and international investors as a barometer of contractual fairness and the stability of India's business environment.